Record Results in 1H and Strong FY 2022 Guidance Upgrade

Adjusted EBIDTA FY 2022 Target up by 30% to €1.3-€1.4 bn

- Sales at €7,949M, organic Growth[ Excluding the Projects segment.] at +12.5% (+13.5% in 2Q)

- Adjusted EBITDA rose to €699M, up by €229M compared to 1H 2021 (+48.7%) Margins improved to 9.4% (at 2021 metal prices)

- Group net profit soared to €259M from €162M (+59.9%) ▪LTM Free Cash Flow at €174M[ Excluding acquisition- and antitrust-related cash outs.]

- Reinforced financial structure: €1.2 bn sustainability-linked term loan signed

Focus on the businesses

- Strong push for the Energy business from renewable sources and power grids for decarbonisation (+13.6% organic growth)

- Telecom: solid performance (+6.6% organic growth driven by optical cables in North America)

- Ongoing improvement for Projects: +28.4% organic growth; margin recovery in 2Q. Greater contribution expected in 2H. €2.4 bn new orders acquired YTD, bringing visibility of total orders to over €10 bn

The Board of Directors of Prysmian S.p.A. approved today the Group’s consolidated results for the first half of 20223

“The acceleration in recent months, after an excellent start to the year, has allowed us to record the best ever first half period, marked by robust sales growth and constantly improving profitability,” commented CEO Valerio Battista. “The efficient management of operations and supply chain and our market and customer focus are confirmed as a strength, even in the uncertain macroeconomic scenario. Most of our markets of operation are highly exposed the energy transition and electrification long-term growth drivers. Energy’s positive performance is attributable to the strengthening and expansion of power grids, a trend that is only partly affected by economic cycles. The energy transition is already benefiting the Projects segment, which in the first half alone acquired orders exceeding €2.4 billion, bringing the visibility of total orders to over €10 billion. As regards Telecom, digitalisation passes through optical fibre, where our range of products has proved to be highly competitive. The excellent results achieved are supported by a sound and sustainable financial structure. The 1H record performances have led to a significant improvement of our FY expectations, with an upwards revision of 30% of our Adjusted EBITDA target,” added Battista.

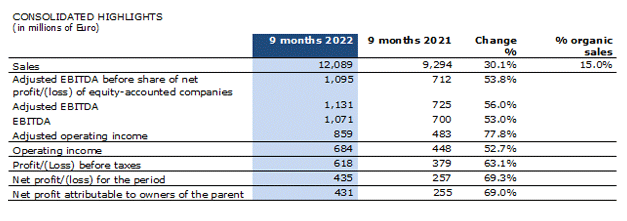

Financial highlights

Group Sales amounted to €7,949 million, with a +12.5% organic change excluding Projects[ +14.3% including the Projects segment.], accelerating in 2Q, with sales organic growth at +13.5% compared to 2Q 2021. The Energy segment reported outstanding performance with a +13.6% organic growth; cables for Power Distribution grew sharply in 2Q, as did Renewables and OEM. Over 50% of the Energy product portfolio is linked to the structural energy transition and electrification drivers. Telecom’s +6.6% organic growth was mostly driven by the positive performance of the optical cable market in North America. The Projects segment — land and submarine power interconnections and wind farm cables — continued to record improving sales (+28.4% organic growth). An even higher and more relevant contribution is expected from Projects in the second half of the year.

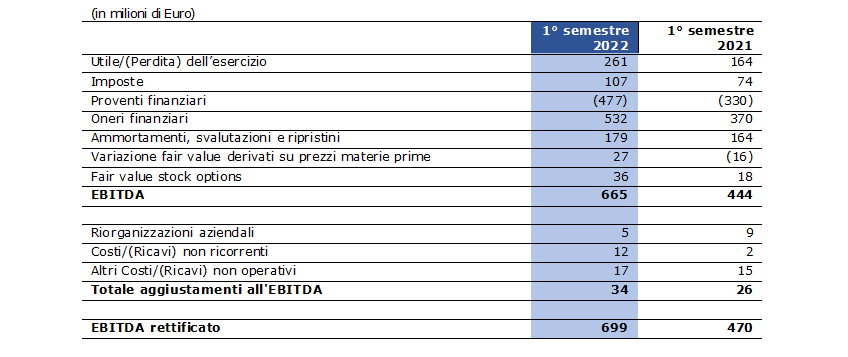

Adjusted EBITDA soared by +48.7% to €699 million, with the ratio to Sales improving to 8.8% (+9.4% ratio to sales at 2021 metal prices) compared to 7.8% in 1H 2021. 2Q saw an excellent acceleration when the Group achieved an Adjusted EBITDA of €411 million, with the crucial contribution of the Energy segment, which benefited from exposure to long-term trends linked to decarbonisation and electrification. Telecom profitability remained stable, whereas Projects’ reported double-digit margins in 2Q, thanks to the positive progress of order execution. Our market and customer focus, our product portfolio management and the efficient management of operations and supply chain allow the Group to best grasp the opportunities generated by the current market phase.

EBITDA grew to €665 million (€444 million in 1H 2021) including net expenses for company reorganisation, net non-recurring expenses and other net non-operating expenses totalling €34 million (€26 million in the first six months of 2021).

Operating Income rose to €423 million compared to 278 million in 1H 2021, while Net Profit attributable to owners of the parent jumped to €259 million compared to €162 million in the same period of 2021.

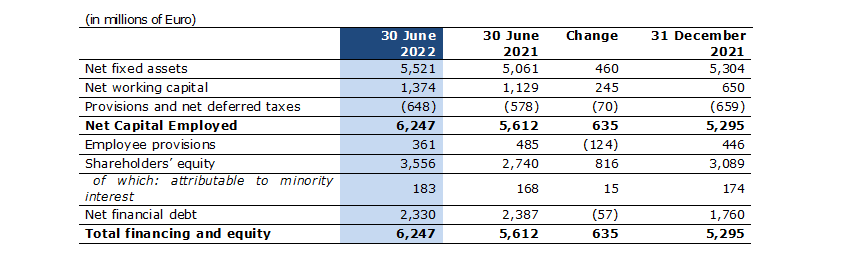

The effective management of net working capital, despite the impact caused by the rise in raw material prices, led to a Free Cash Flow generation of €174 million in the past twelve months (excluding the €19 million cash out for acquisitions and an inflow of €57 million mainly due to settlement agreements reached with third-party counterparties).

Net Financial Debt amounted to €2,330 million at the end of June 2022 (€2,387 million at 30 June 2021 – €1,760 million at 31 December 2021). The factors that led to the Net Financial Debt reduction in the past 12 months were:

- €1,094 million net operating cash flows (before changes in net working capital);

- €15 million net cash flows for payments related to restructuring costs;

- €363 million cash used for increasing net working capital;

- €322 million cash outflows for net investments;

- €67 million net finance costs paid;

- €160 million taxes paid;

- €7 million dividends collected;

- €57 million cash inflows from antitrust disputes;

- €19 million outflows for acquisitions;

- €151 million dividends paid.

*Excluding the Projects segment.

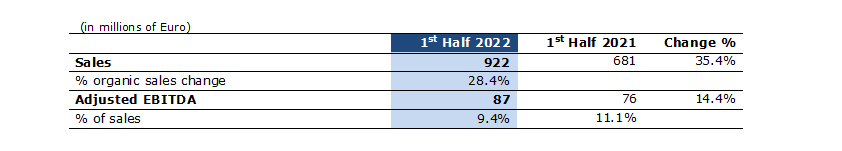

Projects

- margins improvement in 2Q, driven by excellent projects execution

- €2.4 billion orders YTD, order visibility of over €10 billion

- Growing contribution expected for 2H

Projects’ sales amounted to €922 million (+28.4% organic change compared to 1H 2021). Adjusted EBITDA stood at €87 million (€76 million for 1H 2021), with the ratio to Sales at 9.4% (9.7% at 2021 metal prices) compared to 11.1% for the same period of 2021. Results improved sharply in 2Q, with Adjusted EBITDA at €55 million (€32 million in 1Q) and margins back to double-digit levels (10.7%).

The Projects business is expected to contribute more in 2H thanks to progress in executing the important orders in portfolio.

Confirming its undisputed leadership in a market destined to grow exponentially given the strategic role of network infrastructures for energy transition, the Group continued to strengthen its order book with €2.4 billion in new orders acquired YTD. At the reporting date, the order book amounted to €4.3 billion, including only the orders for which the Notice to Proceed has already been issued. This adds to a further €5.8 billion for projects already acquired and expected to be fully accounted for in the order book between 2022 and 2024. The most recent contracts acquired include the development of two submarine interconnections awarded by Red Electrica in Spain worth €250 million.

The German Corridors project contributed significantly to the High Voltage Underground Cables segment, particularly in 2Q, and is expected to grow further, thus playing a key role in Projects’ robust recovery expected in 2H. The Group was awarded a project worth about €700 million by TenneT for doubling the SuedOstLink capacity in Germany.

The Group confirmed its focus on the opportunities arising from the transition to renewable energy sources and a decarbonised economy, which will require massive investments in power grid infrastructure.

Noteworthy is the progress made in developing the first high-voltage submarine cable production hub in the USA, at Brayton Point, Massachusetts, where the first layer of approval of the construction permits has been received. The importance of this plant was also reiterated upon the recent site visit by US President Biden.

Energy

- Robust growth in nearly all geographical areas and markets

- Excellent performance of E&I, OEM and Renewables

- Over 50% of this business linked to the growth drivers based on the energy transition and electrification

Sales of the Energy segment amounted to €6,116 million, with a +13.6% organic growth compared to 1H 2021, owing in particular to the contribution of Energy & Infrastructure and OEM & Renewables, with growth reported across nearly all geographical areas. Over 50% of the Energy segment is linked to the growth drivers of the energy transition and decarbonisation, such as the expansion of power grids, energy generation from renewable sources, the development of electric mobility and of clouding, which are less affected by short-term economic cycles. Profitability improved significantly with Adjusted EBITDA at €474 million (€271 million for the same period of 2021) and growing margins. The ratio of Adjusted EBITDA to Sales was 7.8% (8.4% at 2021 metal prices) compared to 6% in 1H 2021.

Energy & Infrastructure

Energy & Infrastructure sales totalled €4,194 million in 1H, with a +16.5% organic change compared to 1H 2021. Adjusted EBITDA rose to €344 million (€169 million in 1H 2021), with margins substantially increasing, as confirmed by a ratio of Adjusted EBITDA to Sales at 8.2% in 1H 2022 (8.9% at 2021 metal prices) compared to 5.5% in 1H 2021.

Trade & Installers continues to report a positive performance across nearly all regions. The customer focus and efficient supply chain management allow the Group to best grasp the opportunities generated by the current market phase. The Group represents an important and essential partner for its customers.

Power Distribution reported solid growth especially in 2Q, chiefly driven by the power grid expansion plan. The Group has recently signed a global agreement with ENEL for the supply of medium-voltage cables, confirming the validity of its P-Laser technology, which offers a lower environmental impact and a greater performance, and is increasingly recognised as the “energy transition” cable.

Industrial & Network Components

Sales of Industrial & Network Components rose to €1,714 million, with a +8.7% organic change compared to 1H 2021. Adjusted EBITDA reached €130 million (€99 million in 1H 2021) with margins improving to 7.6% (8.1% at 2021 metal prices) compared to 7.3% in 1H 2021.

Specialties, OEM and Renewables grew sharply, supported by energy transition investments. Nearly all applications performed well, and Mining and Infrastructures in particular.

Telecom

- Double-digit growth in optical cables, particularly in North America

- Adjusted EBITDA on the rise and stable margins

Telecom sales amounted to €911 million in 1H, with a +6.6% organic change compared to 1H 2021. Adjusted EBITDA rose to €138 million (€123 million in 1H 2021) with a good margin resilience, as confirmed by the 15.1% ratio to Sales (15.3% at 2021 metal prices) compared to 15.4% in 1H 2021.

Well exposed to the digitalisation drivers, the optical cable business recorded a particularly positive performance with double-digit growth, particularly in North America, with robust volumes and prices.

Europe recorded stable volumes and rising price levels. The main European players have started to grant an upwards revision of prices in light of the increase in commodity and energy prices.

The high value-added business of optical connectivity accessories continued to perform well, fuelled by the development of new FTTx networks (last mile broadband access), particularly in Great Britain.

Multimedia Solutions showed a positive organic growth due to the volume recovery in the North American market.

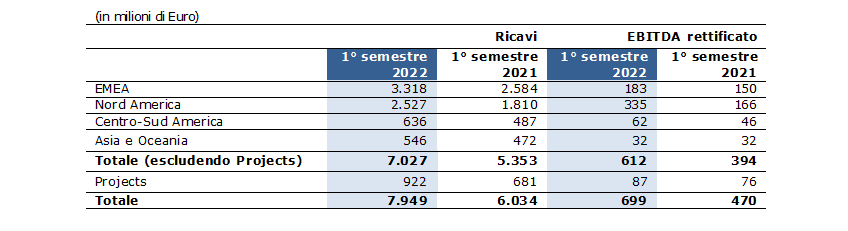

Performance by geographical area (*)

EMEA

Sales in the EMEA area amounted to 3,318 million in 1H 2022, with a +11.1% organic change. Adjusted EBITDA was €183 million (€150 million in 1H 2021). The ratio of Adjusted EBITDA to Sales was 5.5% (5.9% at 2021 metal prices), compared to 5.8% in the same period of 2021. E&I and OEM & Renewables were the main growth drivers.

North America

Sales in this area amounted to €2,527 million, with a +18.7% organic change compared to 1H 2021. Adjusted EBITDA was €335 million (€166 million in 1H 2021). The ratio of Adjusted EBITDA to Sales was 13.2% (14.1% at 2021 metal prices) compared to 9.1% in 1H 2021. All the main businesses reported solid results, also thanks to the leadership position in the region.

LATAM

Sales of the LATAM area totalled €636 million, with a +9.8% organic change. Adjusted EBITDA was €62 million (€46 million in 1H 2021). The ratio of Adjusted EBITDA to Sales was 9.8% (10.5% at 2021 metal prices) compared to 9.5% in 1H 2021. Growth was mainly driven by Renewables, whereas the improvement in Adjusted EBITDA was attributable to E&I and Renewables.

Asia Pacific

Sales in Asia Pacific amounted to €546 million in 1H 2022, with a negative -0.3% organic change. Adjusted EBITDA was €32 million (stable compared to €32 million in 1H 2021). The ratio of Adjusted EBITDA to Sales was 5.9% (6.3% at 2021 metal prices) compared to 6.9% in 1H 2021. Telecom’s results improved, thus allowing to partly offset the decline of Elevators, impacted by the Shanghai lockdown.

Outlook

In 1H 2022, global economy continued to grow sharply as in 2021, thanks to the easing of pandemic restrictions and to national plans in support of the development of infrastructure, energy transition and digitalisation projects. The strong recovery of economic activity was accompanied by considerable inflationary pressure, triggered mainly by the increase in energy and commodity prices and supply chain disruptions, exacerbated by the war in Ukraine. To mitigate rising inflation, several central banks began to pare back some monetary stimuli and to increase interest rates.

Global economic growth expectations for 2022, while remaining positive, have been revised downwards, primarily following the conflict in Ukraine and the related international tensions. After the 6.1% rebound in 2021, the global economy is expected to grow by 3.2% in 2022, according to the most recent estimates issued in July by the International Monetary Fund. This figure has been revised downwards by 0.4% compared to the April 2022 projections. In any event, there continues to be a high level of uncertainty regarding global macroeconomic performance, with risks of further downwards revisions of growth prospects, in view of a possible deterioration of the geopolitical crisis relating to Ukraine, and a resurgence of the pandemic at the global level.

The results for 1H 2022 further confirmed the Prysmian Group’s focus on proactively and seamlessly serving its customers, also leveraging its efficient and geographically widespread industrial footprint. This approach is supported by the excellent results achieved by the Energy segment, which hit a record level in 1H, by the Telecom business’ solid performance and the €2.4 billion orders awarded to the Projects business YTD. In this segment, considering an order backlog of approximately €4.3 billion as well as orders with a total value of 5.8 billion to be included in the backlog in the next 18 months, total order visibility exceeds €10 billion.

As a result, for the full year 2022 Prysmian Group expects a moderate demand growth in the construction and industrial cables businesses after last year’s excellent performance, with results also supported by the ability to implement pricing policies to contain inflation-driven cost pressures. In the high-voltage underground and submarine cables and systems business, the Group aims to confirm its leadership on the market, which is expected grow sharply, driven by the development of offshore wind farms and interconnections to support the energy transition, as well as the start of a significant market uptrend in the United States, where the Group has decided to expand its production capacity and has already obtained the first construction permits for the new submarine cable plant at Brayton Point (Massachusetts). For this segment, the Group expects results to be up on the previous year, with a more marked acceleration in the second half of 2022. In the Telecom segment, the Group forecasts volumes growth in the optical business, mainly thanks to the North American market, where it is strengthening its commitment to meeting the country’s growing demand for broadband optical fibre connectivity.

Prysmian Group's long-term growth drivers are confirmed, mainly linked to the energy transition, the strengthening of telecommunications networks (digitalisation) and the electrification process. The Group can also leverage its broad business and geographical diversification, solid capital structure, efficient and flexible supply chain and lean organisation, all of which is enabling it to effectively seize growth opportunities.

In light of the above considerations and in addition to the Group’s solid performance in 1H 2022, the Group revises its guidance for the FY 2022 upwards compared to that announced in March. For FY 2022, the Group expects an Adjusted EBITDA in the range of €1,300-1,400 million, up by about 30% from the €1,010-1,080 million range previously announced.

Moreover, the Group upgraded the cash generation target as it now expects to generate cash flows of approximately €400-460 million (FCF before acquisitions and disposals) for FY 2022, compared to the previous target of €400 million ± 15%.

These forecasts assume no material changes in both the geopolitical crisis relating to the military conflict in Ukraine and in the development of the health situation. The forecasts also assume that global supply chains will remain under pressure in the coming months, but there will not be any further tensions and extreme dynamics in the prices of factors of production. The forecasts assume, for the upper part of the range, a substantial stability in the current market conditions for the Energy segment, whilst for the lower part, a significant deterioration, particularly with regard to the United States, where the current inflationary and

pricing dynamics provide for considerable profit opportunities. In addition, the forecasts are based on the Company's current business scope, assuming a EUR/USD exchange rate of 1.05, and do not include impacts on cash flows related to Antitrust issues.

ANNEX A

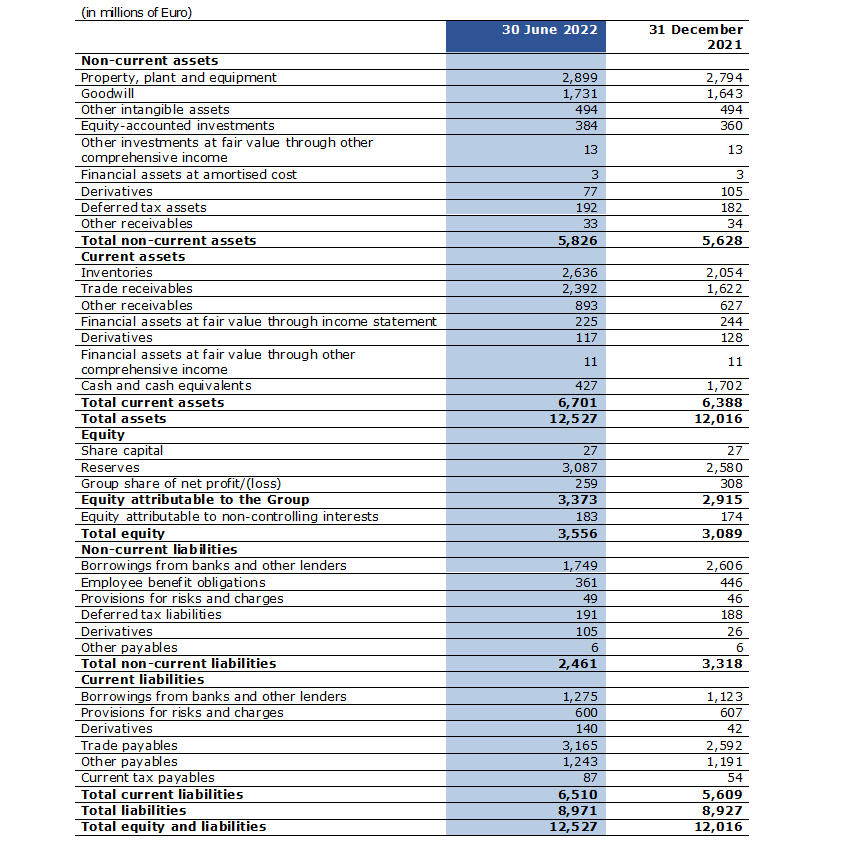

Consolidated Statement of Financial Position

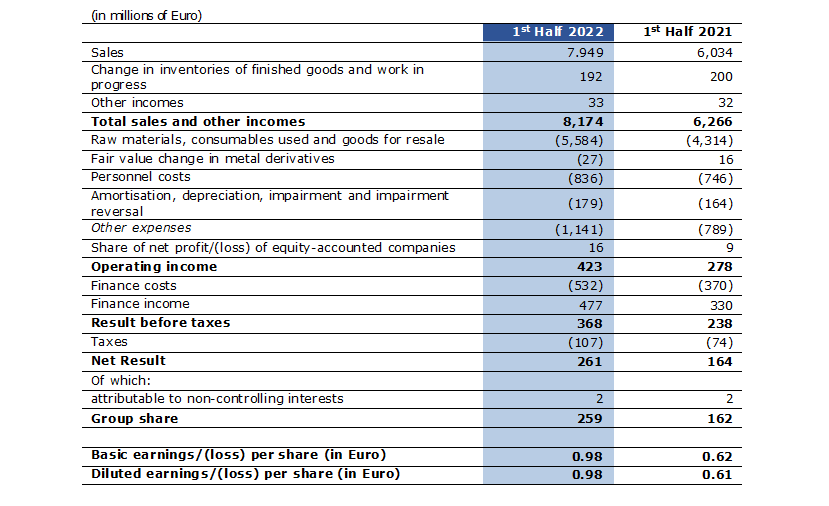

Consolidated Income Statement

Consolidated Income Statement - 2Q results (*)

(*) Data referring to 2Q 2022 and 2Q 2021 have not been subject to limited audit

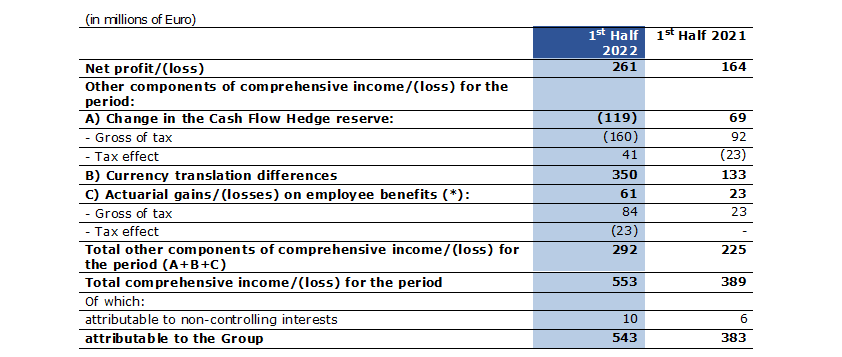

Consolidated Statement of Comprehensive Income

(*) The Statement of Comprehensive Income items which cannot be restated in the net result of the year in subsequent periods

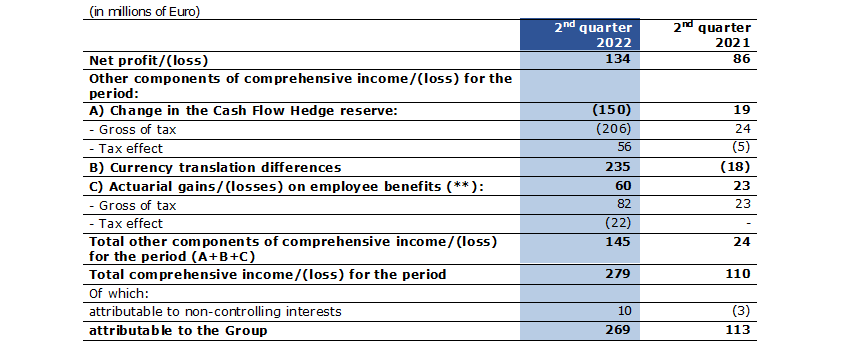

Consolidated Statement of Comprehensive Income - 2Q results (*)

(*) Data referring to 2Q 2022 and 2Q 2021 have not been subject to limited audit (**) The Statement of Comprehensive Income items which cannot be restated in the net result of the year in subsequent periods

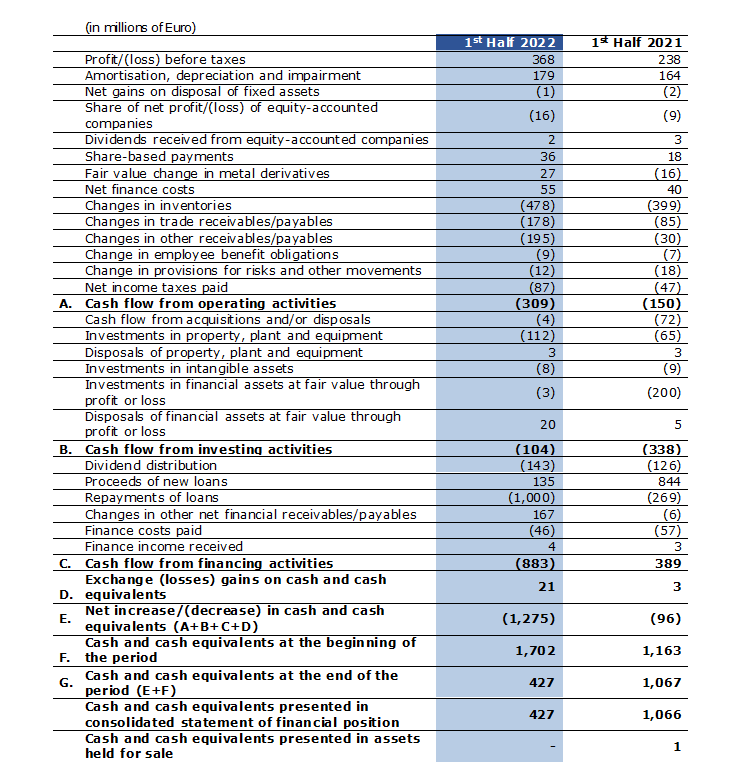

Consolidated Statement of Cash Flows

ANNEX B

Reconciliation table between Net result, EBITDA and adjusted EBITDA of the Group

Statement of Cash Flows with reference to change in net financial position