General Cable Integration with Prysmian

Key Rational of the Merger

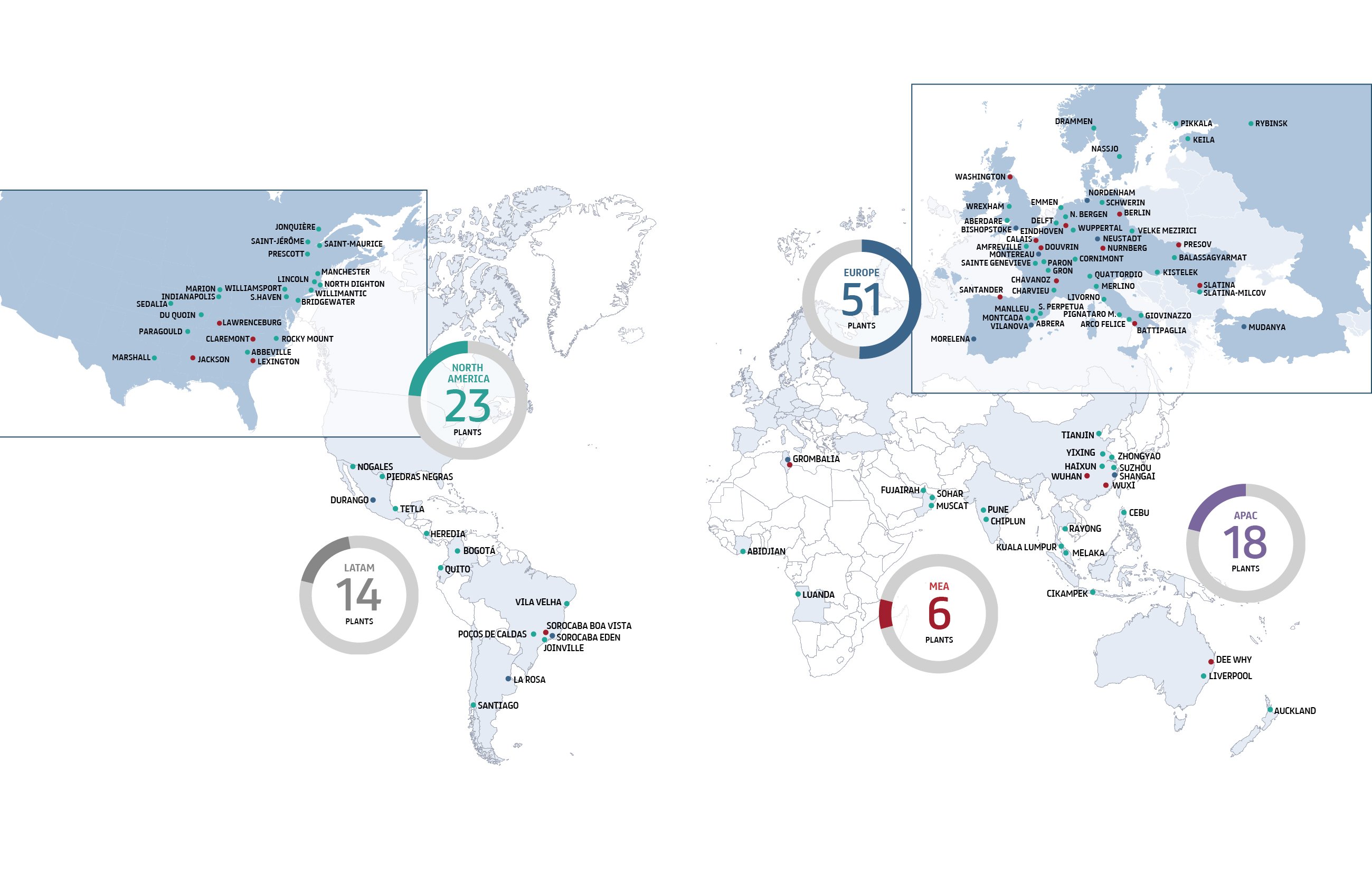

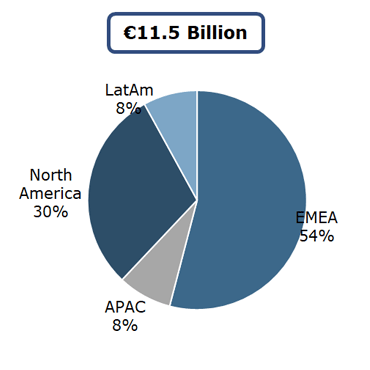

Worldwide Leadership

Toggle DetailsThe combination of Prysmian and General Cable will enable the creation of a truly Global and Leading player in the Cable Industry, with approximately 11 billion Euro of annual turnaround and 30,000 employees, with presence in more than 50 countries worldwide.

Complementary Geographic Presence

Toggle DetailsAn highly complementary geographical presence of Prysmian and General Cable increases the capability to exploit global trends, with a more balanced exposure between Europe and North America and a reduced risk of geographic overlap.

Extended Product Portfolio

Toggle DetailsThe combination of the highly complementary product portfolios of Prysmian and General Cable will allow to extend and complete the Group's offer, leveraging on the technological excellence achieved by each company in many business areas.

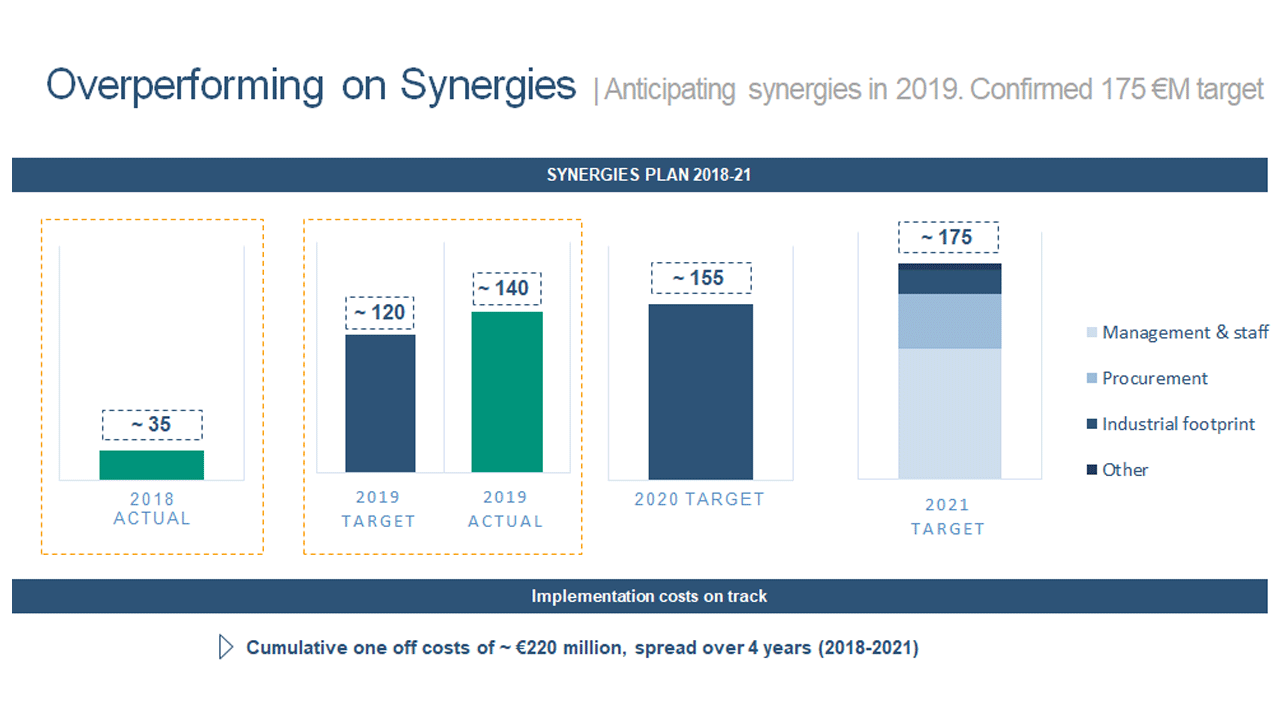

Multiple Sources of Synergies

Toggle DetailsThe integration between Prysmian and General Cable enables substantial synergies generation, leveraging on proven Prysmian's execution capability. The main synergies sources identified involve procurement centralization, overhead costs' reduction, manufacturing footprint optimization, net working capital management and financing cost reduction.