Q3 & 9M25 Integrated Results

Prysmian Upgrades 2025 Guidance

- THIRD QUARTER IS PRYSMIAN’S BEST EVER: ORGANIC GROWTH AT +9.2%, WITH MARGINS1 (14.8%) AND ADJ. EBITDA (€644 MILLION, +19.3% VS. Q3’24) CONTINUING POSITIVE MOMENTUM

- TRANSMISSION Q3 REVENUES RISE SIGNIFICANTLY (+39.0% ORG. GROWTH), WITH CONTINUED MARGIN ENHANCEMENT REACHING 17.8% (15.3%, Q3’24)

- POWER GRID Q3 ORGANIC GROWTH ACCELERATES (+14.8%) AND ADJ. EBITDA RISES TO €125 MILLION (€119 MILLION, Q3’24)

- INDUSTRIAL & CONSTRUCTION Q3: POSITIVE ORGANIC GROWTH (+2.0%) DRIVEN BY NORTH AMERICA (+10%). SOLID MARGINS AT 14.5%

- CHANNELL HELPS BOOST DIGITAL SOLUTIONS MARGINS (19.6% VS. 14.3%, Q3’24). Q3 ORGANIC GROWTH AT +13.3%

- SOLID CASH GENERATION WITH FREE CASH FLOW LTM AT €859 MILLION

- SIGNIFICANT ACCELERATION IN RECYCLED CONTENT, REACHING 20.7% (+4.5 P.P. VS. FY24); PERCENTAGE OF SUSTAINABLE REVENUES RISES TO 44.4% (43.1%, FY24)

- FY25 OUTLOOK UPGRADED THANKS TO THE EXCELLENT PERFORMANCE OF TRANSMISSION AND THE NORTH AMERICA REGION

Massimo Battaini, Prysmian CEO, said: “Prysmian continues to achieve excellent profitability and revenue growth. The performance in this quarter, the best in Prysmian’s history, underlines that our ‘Accelerating Growth’ strategy places us in the best position to capture all the opportunities in the market while enabling the development and security of both energy and digital infrastructures. This is seen in the performance of Transmission and Power Grid, and the enhanced revenues and profitability in Digital Solutions, also thanks to the contribution from Channell. The continued strength of our I&C business, with solid margins and growing revenues also reflects the benefits that the business has from the exposure to important drivers such as data centers. Thanks to these results, in particular the excellent performance of Transmission and the North America region, we have decided to upgrade the guidance for the second time this year as we continue to increase value for all stakeholders.”

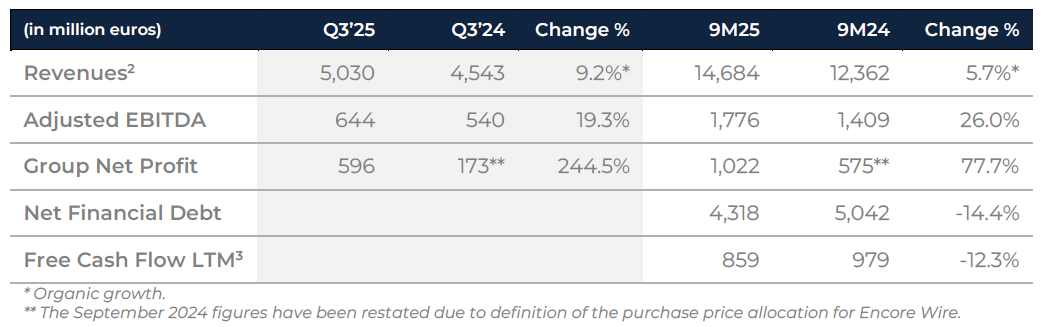

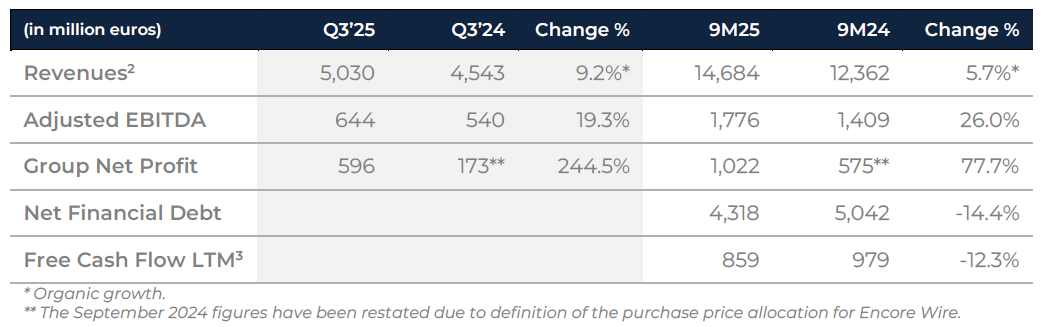

FINANCIAL HIGHLIGHTS

The Board of Directors of Prysmian S.p.A. has approved the Group’s consolidated results for the third quarter, and the first nine months of 2025.

Group Revenues in the third quarter stood at €5,030 million, up from €4,543 million in Q3’24 with +9.2% organic growth. In Q3, Transmission continued its outstanding organic growth (+39.0%), while there was significant acceleration in both Power Grid (+14.8%), reflecting strong performance in North America and Europe, and Digital Solutions (+13.3%). In Electrification, there was organic growth in Industrial & Construction (+2.0%) driven by North America (+10%), while Specialties contracted (-3.0%).

In 9M25, Revenues reached €14,684 million (€12,362 million, 9M24), with +5.7% organic growth.

Revenues reflect the inclusion within the perimeter of both Encore Wire, which was fully consolidated as of July 1, 2024, and Channell, as of June 1, 2025.

Adjusted EBITDA in Q3’25 reached €644 million, up 19.3% compared to €540 million in Q3’24. The overall margin at standard metal prices was 14.8%, up from 13.8% in Q3’24. In the third quarter, Transmission’s Adjusted EBITDA rose significantly to €152 million (€92 million, Q3’24), as did the margin, reaching 17.8% (15.3%, Q3’24). In Power Grid, Adjusted EBITDA was €125 million (€119 million, Q3’24), while the margin was 14.7% (15.2%, Q3’24). In Electrification, Adjusted EBITDA in Industrial & Construction was €212 million (€211 million, Q3’24), and the margin was solid at 14.5%, in line with Q3’24. In Specialties, Adjusted EBITDA was €70 million (€72 million, Q3’24), while the margin improved to 11.2% (11.1%, Q3’24). Digital Solutions saw continued profitability expansion, with

Adjusted EBITDA almost doubling to €88 million (€45 million, Q3’24), and the margin increased significantly to 19.6% (14.3%, Q3’24), also thanks to the contribution from Channell. In 9M25, Adjusted EBITDA was €1,776 million (€1,409 million, 9M24) and the margin was 14.1%, up from 13.0% in 9M24. EBITDA increased in 9M25 to €2,099 million (€1,269 million, 9M24).

Group Net Profit in 9M25 was €1,022 million versus €575 million in 9M24, also thanks to the gain (€354 million) coming from the sale of the stake in YOFC.

Free Cash Flow LTM was €859 million, decreasing versus €979 million LTM in June 2025, mainly due to the different distribution of Transmission cash flows over the quarters.

Net Financial Debt decreased to €4,318 million from €5,042 million at September 30, 2024. The decrease mainly reflects:

- Free Cash Flow earned in the last twelve months for €859 million generated by:

- €1,880 million net cash flow provided by operating activities (before changes in net working capital);

- €26 million net cash flow absorbed by changes in net working capital;

- €779 million cash outflows for net capital expenditure;

- €226 million payments of net finance costs;

- €10 million dividends received from associates;

- the issued hybrid bond (net effect decreasing net debt for €970 million);

- the proceeds from the sale of the stake in YOFC for €566 million;

- the acquisitions, mainly the Channell and Warren & Brown transactions (+€928 million);

- the share buyback launched in June 2024 (+€210 million);

- the dividend paid to shareholders (+€239 million).

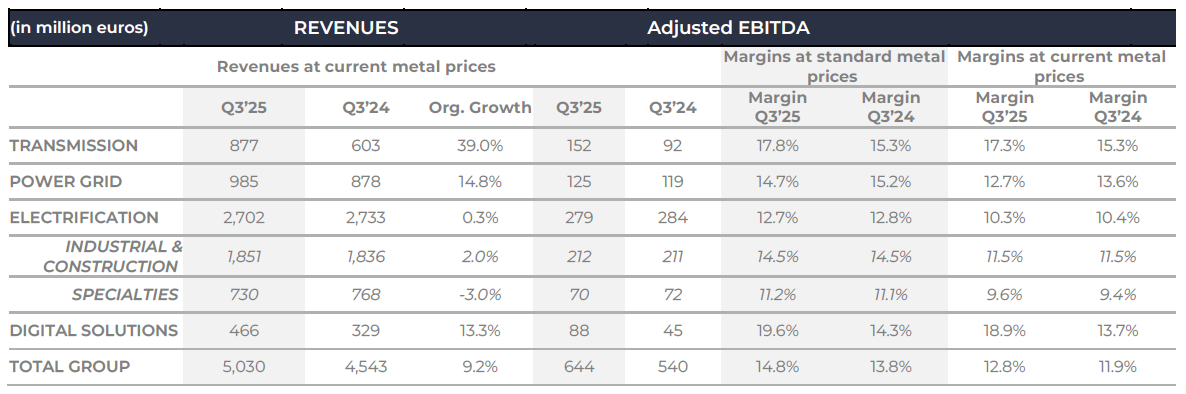

BUSINESS OVERVIEW Q3 2025

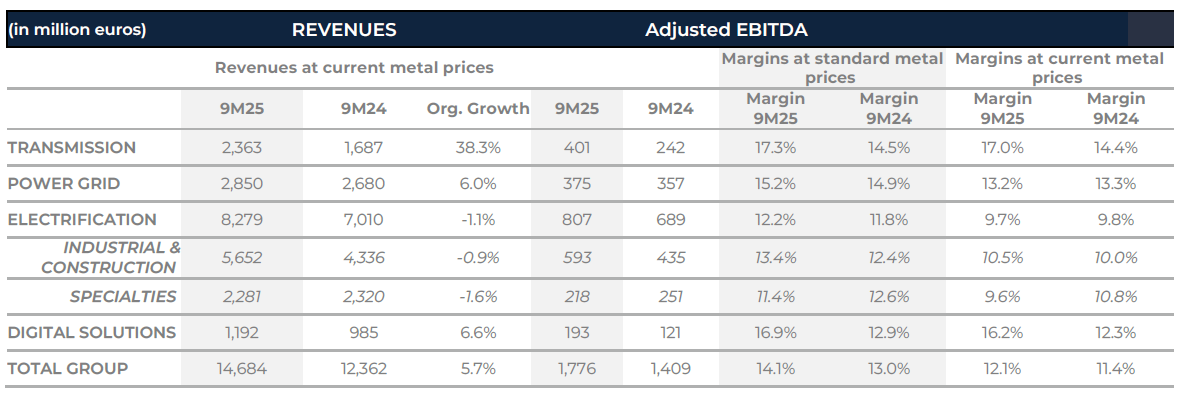

BUSINESS OVERVIEW 9M

TRANSMISSION

Transmission continued to achieve outstanding organic growth and an increase in profitability due to capacity expansion, smooth project execution, and enhanced project mix.

In the third quarter, Revenues grew significantly to reach €877 million (+39.0% organic growth).

Adjusted EBITDA also grew from €92 million in Q3’24 to €152 million in Q3’25. The margin improved significantly to reach 17.8% (15.3%, Q3’24).

In 9M25, Revenues were €2,363 million (+38.3% organic growth). Adjusted EBITDA was €401 million (€242 million, 9M24), while the margin increased by 2.8 p.p. to reach 17.3%.

The backlog stood at approximately €16 billion. In addition, Prysmian was awarded orders (including EGL4 and Tunita) for an approximate value of €3 billion which has not yet been included in the backlog.

POWER GRID

There was strong acceleration in growth and robust profitability in Power Grid. This was driven by strong performance in North America and Europe. In the third quarter, Revenues grew significantly to reach €985 million (+14.8% organic growth).

Adjusted EBITDA was €125 million, up from €119 million in Q3’24. The margin was 14.7% (15.2%, Q3’24).

In 9M25, Revenues were €2,850 million (+6.0% organic growth). Adjusted EBITDA grew to €375 million, up from €357 million in 9M24, while the margin was 15.2% (14.9%, Q3’24).

ELECTRIFICATION

Industrial & Construction

There was solid profitability, and positive organic growth, in Industrial & Construction, driven by North America, while partially offset by other geographies.

In the third quarter, Revenues were €1,851 million (+2.0% organic growth), driven by North America (+10% organic growth). Adjusted EBITDA stood at €212 million (€211 million, Q3’24), while the margin was 14.5%, in line with Q3’24. In 9M25, Revenues stood at €5,652 million (-0.9% organic growth) versus €4,336 million in 9M24.

Adjusted EBITDA was €593 million (€435 million, 9M24) and the margin reached 13.4% (12.4%, 9M24).

The results include Encore Wire, which has been fully consolidated as of Q3’24.

Specialties

The Specialties business was stable, despite negative performance of the Automotive and Elevators businesses. In the third quarter, Revenues reached €730 million (-3.0% organic growth).

Adjusted EBITDA was €70 million (€72 million, Q3’24). The margin was stable at 11.2% (11.1%, Q3’24).

In 9M25, Revenues were €2,281 million (-1.6% organic growth). Adjusted EBITDA was €218 million (€251 million, 9M24) and the margin was 11.4% (12.6%, 9M24).

DIGITAL SOLUTIONS

The performance of Digital Solutions was excellent, benefiting also from sound contribution from Channell, which was consolidated as of June 1, 2025.

In the third quarter, Revenues accelerated significantly to €466 million (+13.3% organic growth).

Adjusted EBITDA almost doubled to €88 million (€45 million, Q3’24). The margin was up significantly to reach 19.6% (14.3%, Q3’24).

In 9M25, Revenues stood at €1,192 million (+6.6% organic growth). Adjusted EBITDA rose to €193 million (€121 million, 9M24) and the margin rose to 16.9% (12.9%, 9M24).

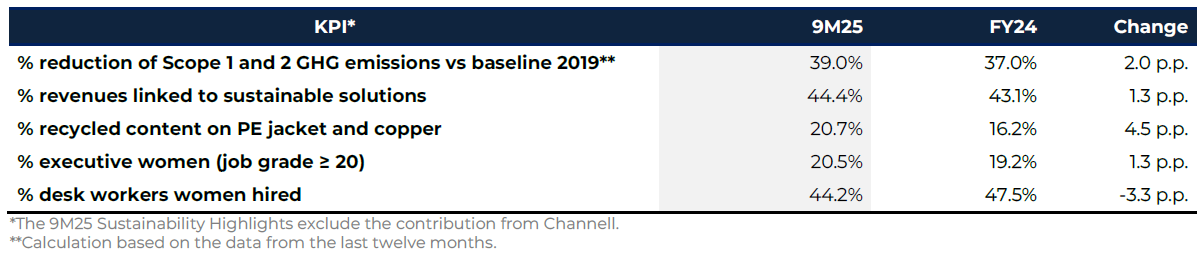

SUSTAINABILITY HIGHLIGHTS

The 9M25 results confirm Prysmian’s consistent progress on its firm commitment to decarbonization and achieving the social and environmental targets set out at the Capital Markets Day in New York City in March 2025.

Scope 1&2 GHG LTM emissions reduction versus the 2019 baseline reached -39% (-37%, FY24).

The percentage of Revenues linked to sustainable solutions rose to 44.4% (43.1%, FY24).

In line with Prysmian’s focus on the circular economy, there was a continued increase in the percentage of recycled content, which rose to 20.7% (16.2%, FY24) mainly driven by North America, and in particular due to the contribution from Encore Wire.

The percentage of women in executive positions was 20.5% (19.2%, FY24).

The percentage of women desk workers hired was 44.2% (47.5%, FY24).

OUTLOOK

Based on the strong performance in the first nine months of the year, and the excellent contribution from both the Transmission business and the North American region, Prysmian has decided to further upgrade its guidance for FY25 compared to the outlook provided in July:

- Adjusted EBITDA in the range of €2,375-€2,425 million previously €2,300-€2,375 million

- Free cash flow in the range of €1,025-€1,125 million previously €1,000-€1,075 million

- Scope 1&2 GHG emission reductions in the range of -38% and -40% vs 2019

This guidance assumes no material changes in the geopolitical situation, in addition to excluding extreme dynamics in the prices of production factors, significant supply chain disruptions or relevant changes in tariffs. The forecasts are based on the Company's current business perimeter, on a EUR/USD yearly average exchange rate of 1.14, and do not include impacts on cash flows related to Antitrust issues.

EVENTS AFTER SEPTEMBER 30, 2025

For significant events that took place after September 30, 2025, please refer to the dedicated section on the corporate website www.prysmian.com.

CONFERENCE CALL

The results of the third quarter of 2025 will be presented to the financial community during a conference call today at 10:00 CET. Below you will find the link to access the webcast: https://edge.media-server.com/mmc/p/zrf5nvg9/.

A recording of the conference call will be subsequently available on the Group’s website: www.prysmian.com. The documentation used during the presentation will be available today in the Investor Relations section of the Prysmian website at www.prysmian.com and can be viewed on the Borsa Italiana website www.borsaitaliana.it and in the central storage mechanism at www.emarketstorage.com.

Download a copy of the presentation here.

To learn more, visit the Prysmian Investors Results Center.